Servicios al cliente

Sobre nosotros

Copyright © 2025 Desertcart Holdings Limited

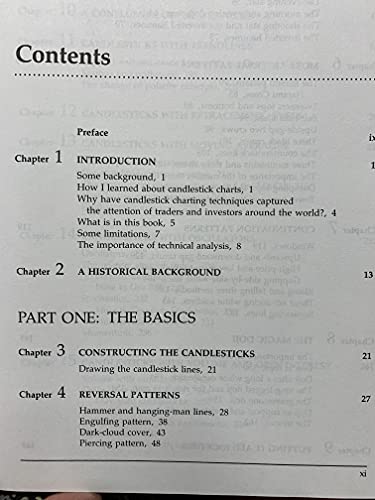

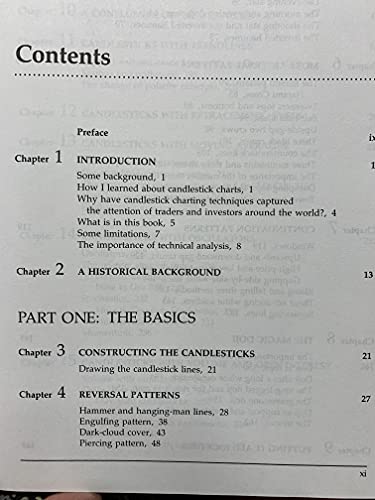

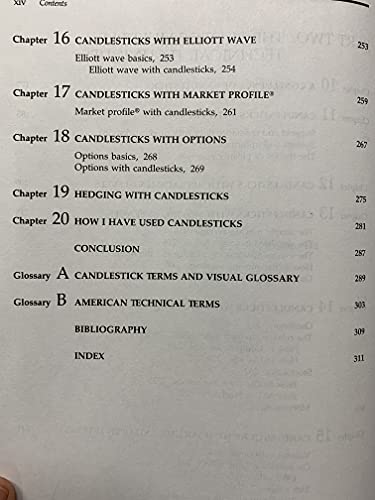

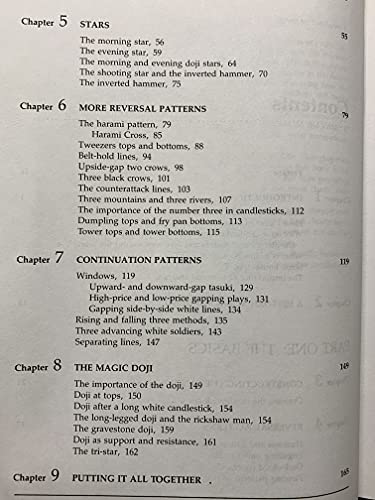

Buy Japanese Candlestick Charting Techniques: A Contemporary Guide to a Client Investment Technique Far East 1 by Nison (ISBN: 9780139316500) from desertcart's Book Store. Everyday low prices and free delivery on eligible orders. Review: good - prompt delivery, good product Review: Worth reading - I purchased this book not knowing anything about candlestick charting and having read it feel more confident when reading candlestick charts. The book is very clear in laying out the candlestick patterns, with plenty of example charts. The only problem I found is that I was constantly flicking back and forth between the charts and the chart text, which was often a page ahead. I would recommend this book, but it's no bible, I wouldn't use candlestick patterns on their own when making trading decisions I'd use other indicators along with them. I must admit that all my charts are candlesticks now and feel the book was worth the money I paid.

| Best Sellers Rank | 1,124,316 in Books ( See Top 100 in Books ) 9,394 in Professional Finance |

| Customer reviews | 4.5 4.5 out of 5 stars (70) |

| Dimensions | 21.64 x 2.31 x 28.65 cm |

| Edition | 1st |

| ISBN-10 | 0139316507 |

| ISBN-13 | 978-0139316500 |

| Item weight | 1.22 kg |

| Language | English |

| Print length | 384 pages |

| Publication date | 16 April 1999 |

| Publisher | Prentice Hall |

H**Y

good

prompt delivery, good product

D**N

Worth reading

I purchased this book not knowing anything about candlestick charting and having read it feel more confident when reading candlestick charts. The book is very clear in laying out the candlestick patterns, with plenty of example charts. The only problem I found is that I was constantly flicking back and forth between the charts and the chart text, which was often a page ahead. I would recommend this book, but it's no bible, I wouldn't use candlestick patterns on their own when making trading decisions I'd use other indicators along with them. I must admit that all my charts are candlesticks now and feel the book was worth the money I paid.

T**M

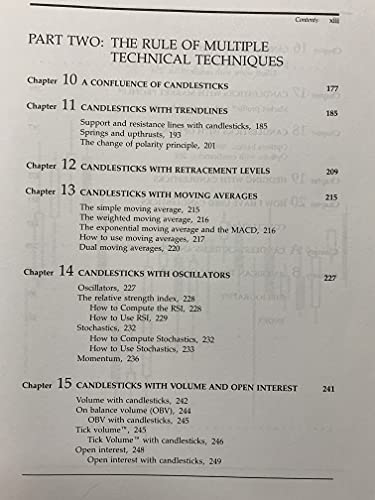

Useful and interesting teaching. This is one of his first texts. The concepts are timeless, so don’t let that discourage you. I find the discussions about Japanese history and word useage makes the teaching flow well. At the same time, trading application is sound. This text complements other technical analysis applications. In fact, Mr. Nison develops the concept of using multiple tools quite well.

S**E

Whether you are a short or long term trader, this book is a must have. Once you read this book, you will want to use no other charting method but candlesticks. More important than teaching very common chart patterns, you come away with a good understanding of what each type of candlestick is telling you about the psychology of the market you are studying. Although his clear illustrated examples use mostly futures, these methods definitely apply to equities as well. You will no longer fear shorting a stock when you can clearly see the "dark cloud cover" on strong volume. If you want to know more about technical charting and have money for only one book, this is it.

F**A

Recommend it

J**S

The most important reason to read this book is to learn candlestick charting. The next best reason is that this is a fine well written book for novices and experts alike. Nison gives clear explanations of the indicators important in candlestick charting, and then goes on to explain why the indicators are strong or weak. The result for me was that I learned some very concrete techniques while also gaining a deeper understanding of market behavior in general. In many areas the Japanese interpretation of chart events differ from the Western view, and this is most fascinating. I highly recommend this book for novices and beyond.

J**E

I have a few other books on Candlesticks and this one is one of the best. Mr. Nison not only explains the candlestick but puts it in context to explain it's true meaning. I would have liked it if he had given a few more examples with greater detail, because candlesticks are almost meaningless unless you put them in context. For example the candlestick---(Hammer) is fairly meaningless if is occur in a consolidation pattern. If it occurs during a correction of any kind, and especially a deep one, and if the tail of the hammer is 2 to 4 times the length of the previous candle, you should have paid attention because the odds are very, high that a trend reversal is about to take place. This level of detail is missing. I must add that Mr. Steven Bigalows books are equal to Mr. Nison's but may be a bit pricey. I am not a member of Mr. Bigalow's web site, nor am connected with anything he does. I respect his work, especially what I see on YOUTUBE.

Trustpilot

Hace 2 días

Hace 2 semanas